Tax Tips: Concessional Contributions and Carry-Forward arrangement

Making a carry-forward contribution can be an easy way to boost the balance of your super account whilst also utilising the tax benefit available.

We will run through what a concessional contribution is, as well as how you can utilise the carry-forward option for unused concessional contributions.

What is a concessional super contribution?

Concessional contributions are any of the contributions paid into your super account that receive a concessional (or lower) tax rate. They are contributions made into your account from money that has not yet been taxed (generally by your employer). Concessional super contributions are taxed at the special low rate of 15% (if your income is under $250,000) to help you save for your retirement. For many people this tax rate is lower than their marginal tax rate.

What are carry-forward contributions?

This means if you don’t use the full amount of your concessional contributions cap ($27,500 in 2021–22), you can carry forward the unused amount and take advantage of it up to five years later. (From 1 July 2017 to 30 June 2021, the annual general concessional contributions cap was $25,000).

How long do I have to utilise unused concessional contributions?

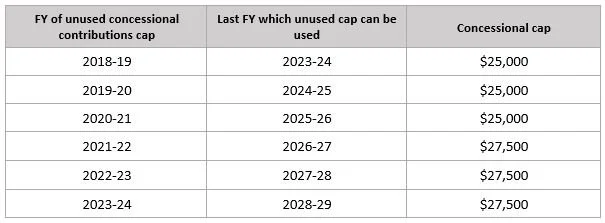

After five years, any of your unused concessional contributions cap amounts will expire. See the table below:

Are you eligible?

You must meet two conditions to be able your unused concessional cap amounts:

Your Total Super Balance (TSB) must be under $500,000 at 30 June in the previous financial year. For example, if you want to make a carry-forward concessional contribution in 2021–22, your TSB must have been under $500,000 on 30 June 2021.

You made concessional contributions in the financial year that exceeded your general concessional contributions cap.

If you have any questions about concessional contributions, please contact us on (07) 3285 2633.